5 Beginner-Friendly Apps for Buying and Tracking Stocks

Image: Unsplash

Image: Unsplash

These days, you don’t need to work with a fancy stockbroker or understand Wall Street lingo to start investing. Thanks to mobile apps, you can buy stocks from your phone—anytime, anywhere. All it takes is a smartphone, a solid internet connection, and a little curiosity.

If you’ve ever thought about investing but felt unsure where to begin, you’re in the right place. There are tons of apps out there, but not all of them are easy to use or made with beginners in mind. In this article, we’ll help you figure out what to look for in a stock investing app and introduce you to some of the best beginner-friendly options to help you buy and track your stocks with confidence.

What Makes an App Beginner-Friendly?

When you’re just starting, the learning curve can feel steep. A good investing app will smooth that curve with intuitive design, simple language, and educational resources that guide you every step of the way.

Look for apps that:

- Have a clean, easy-to-use interface

- Offer commission-free trades

- Provide real-time data and tracking tools

- Include educational materials for financial literacy

- Offer practice or demo accounts (optional but helpful)

These features help reduce confusion and build your confidence as a new investor.

Top Beginner-Friendly Apps to Consider

1. Robinhood – Investing Made Simple and Accessible

Robinhood was one of the first apps to truly shake up the stock trading world by removing trading fees. It made investing feel less intimidating, especially for younger or first-time investors. With a clean, easy-to-use interface, Robinhood allows you to buy stocks, ETFs, and even cryptocurrencies—all from your phone.

You don’t need a lot of money to get started. You can invest as little as $1 thanks to fractional shares, which means you can buy just a small piece of a stock instead of a full share. This makes it perfect if you’re starting small or just want to try things out without a big commitment.

What You’ll Like About Robinhood:

- Zero Commission Fees: You won’t pay a fee when you buy or sell stocks.

- Fractional Shares: Invest in big-name stocks like Apple or Tesla, even with a few dollars.

- User-Friendly Dashboard: Everything is simple to navigate, with real-time updates and alerts.

- Quick Setup: Opening an account and getting started is fast, usually under 10 minutes.

What to Keep in Mind:

- Limited Research Tools: Robinhood keeps it simple, which is great for ease of use, but you won’t find deep analytics or stock ratings like on more advanced platforms.

- Basic Charts: You get price charts, but not a lot of customization or historical data.

Best For: New investors who want a no-fuss way to learn by doing, especially if you’re interested in trading stocks or crypto without paying fees.

2. Public – Investing with a Social Twist

If you’re someone who likes to learn from others or enjoys a more community-based experience, Public might be your kind of app. It combines the functionality of a stock investing app with the feel of a social network. You can follow other investors, see what stocks they’re buying, and read their thoughts on the market.

Public is also transparent about how it makes money, avoiding the controversial “payment for order flow” model. This means they don’t sell your trades to third parties—something many users appreciate for ethical reasons.

Why People Love Public:

- Fractional Investing: Like Robinhood, you can buy slices of stock with just a few dollars.

- Built-in Learning: The app offers helpful content and beginner guides. You’ll also find real conversations happening between users about market trends.

- No Hidden Fees: Public is clear about its pricing and keeps things straightforward.

- Community Features: Follow experienced investors, comment on trades, and ask questions—great for beginners who learn by observing.

A Few Limitations:

- Not Ideal for Deep Research: While great for casual users, it doesn’t offer in-depth tools or screeners for serious stock analysis.

- Limited Investment Types: You can invest in stocks and ETFs, but not in mutual funds, bonds, or crypto (as of now).

Best For: Beginners who want a more interactive and social investing experience without feeling overwhelmed by technical jargon.

3. Fidelity – A Trusted Name That’s Surprisingly Great for Beginners

When you hear Fidelity, you might think it’s only for seasoned investors or people with large portfolios. But that’s not the case anymore. Fidelity has worked hard to make their platform approachable, even if you’re just starting.

What sets them apart is their combination of professional-grade tools with no account minimums and zero trading fees, all wrapped in a clean mobile experience. You get the credibility of a long-standing brokerage, plus tools that grow with you as you become a more confident investor.

What’s Great About Fidelity:

- No Account Minimums: Start investing without needing a large lump sum.

- Zero Commissions: No fees for trading U.S. stocks and ETFs.

- Fractional Shares (Fidelity Slices): Buy pieces of your favorite stocks starting at just $1.

- Top-Notch Research: Access detailed reports, analyst ratings, and data-driven tools if you want to dive deeper.

- Strong Customer Service: Live chat, phone support, and local branches if you want in-person help.

Things to Consider:

- Interface May Feel Busy at First: Compared to apps like Robinhood, Fidelity has more features, which can feel overwhelming in the beginning.

- Not the Trendiest Design: The design isn’t as sleek or “fun” as some newer apps, but it’s built for serious investing.

Best For: New investors who want an app they won’t outgrow—something that starts simple but offers advanced features when you’re ready to explore more.

4. SoFi Invest – More Than Just Investing

SoFi Invest is part of the larger SoFi ecosystem, which offers everything from student loan refinancing to credit cards. Their investing app is designed with beginners in mind, offering a mix of automated investing (hands-off) and active investing (choose your stocks), depending on your comfort level.

If you’re not quite sure where to start, SoFi gives you access to financial advisors at no extra cost—something rare in free apps.

Why Beginners Like SoFi Invest:

- No Commissions or Minimums: Start small with zero fees.

- Fractional Shares: Invest in popular stocks with just a few bucks.

- Auto-Invest Options: Set it and forget it. SoFi will manage your portfolio based on your goals.

- Access to Advisors: You can talk to a financial advisor, I mean an actual human, for free.

- Clean, Modern App: The interface is beginner-friendly and easy to navigate.

What’s Not Ideal:

- Limited Research Tools: If you like digging into stocks or screening based on detailed criteria, you might find it lacking.

- Fewer Investment Options: Mainly focused on stocks and ETFs, with limited extras like options or bonds.

Best For: First-time investors who want both flexibility and guidance, and those already using SoFi for other financial needs.

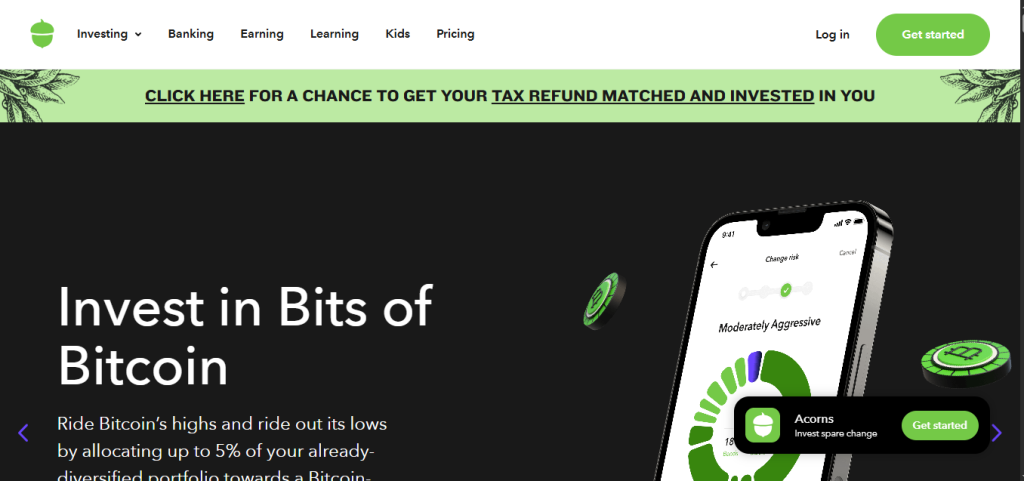

5. Acorns – Investing Spare Change Automatically

Acorns is built around a simple idea: small amounts can add up over time. It’s especially great for people who feel like they don’t have enough money or time to invest. The app rounds up your everyday purchases (like $4.20 at the coffee shop) to the nearest dollar and invests the difference.

For example, if your coffee costs $4.20, Acorns rounds it up to $5.00 and invests that 80 cents into a diversified portfolio. It’s like saving and investing behind the scenes without having to think about it.

Why Acorns Stands Out:

- Effortless Investing: You don’t have to remember to invest. The app does it automatically.

- Pre-Built Portfolios: You’re matched with a portfolio based on your goals and risk level.

- “Found Money” Rewards: Some partnered brands will invest in your account when you shop with them.

- Great for Saving Too: Acorns has features for retirement accounts, recurring deposits, and even kids’ accounts.

Potential Downsides:

- Monthly Fee: Acorns charges a small subscription fee (starting at $3/month), which could eat into gains if your balance is still small.

- Less Control: Since it’s automated, you can’t pick individual stocks or customize much.

Best For: People who want a passive way to start investing and save money at the same time, especially if they don’t have a lot of disposable income.

Features That Help You Track Stocks Like a Pro

Tracking your investments is just as important as buying them. Good stock tracking apps should provide real-time updates, customizable watchlists, and easy-to-read performance reports.

Features to look for:

- Alerts on price movements

- Daily/weekly performance reports

- Earnings announcements

- Company news integration

Apps like Yahoo Finance, Morningstar, or even Google Finance can supplement your main investing app by offering deeper tracking and analysis.

How to Choose the Right App for You

Choosing the right app isn’t about picking the most popular one. It’s about what works best for your goals, learning style, and how hands-on you want to be.

Ask yourself:

- Do I want to pick my stocks or invest automatically?

- Am I interested in learning more about the stock market?

- Will I be trading frequently or investing long-term?

The answers to these questions will help narrow down your choices.

Getting Started: What to Expect

Most apps make it easy to sign up. You’ll need some personal information like your SSN (for U.S. apps), banking details, and an idea of your risk tolerance. Once approved, you can start investing almost immediately.

Take your time to explore the app, watch tutorials, and even start with a small amount just to understand how things work. You don’t need to go all in from day one.

Mistakes to Avoid as a New Investor

Even with the best app, it’s easy to make beginner mistakes:

- Don’t invest money you can’t afford to lose

- Avoid chasing trending stocks without research

- Don’t panic-sell during market dips

- Stay consistent and think long term

These apps can empower you, but discipline and education are still key to success.

Use Technology to Your Advantage

Stock investing has never been more accessible. With beginner-friendly apps, even someone with zero experience can build a portfolio, track performance, and grow wealth over time. The key is to pick a platform that suits your style and commit to learning as you go.

Your first investment might be small, but the journey can be rewarding with the right tools and habits. Let these apps be your co-pilot as you take your first step into stock investing.

Hey! I'm Akpan Unwana, the founder of MoneyBreez. I am a digital entrepreneur, graphic and web designer who loves to use the digital space to generate income, freedom and meaningful opportunities. Over the years, I have been able to understand how design, creativity, and clever investing can be used to build real opportunities online

I write on MoneyBreez about real life tips on how to earn online, using emerging technologies to create wealth and be a smarter person with money.